CR(Corporate Restructuring) aims to contribute to industrial restructuring for marginal companies, expanding the virtuous cycle of maximizing funds profit and normalizing early management of marginal companies.

Investment target

Representative Investment Targets

As marginal companies are main investment targets, the companies can proceed stable business activities with improved financial structure after the investments.

- Having excessive debt over corporate value

- Having signs of insolvency such as lack of working capital

- Having applied for rehabilitation procedures

- Signed a financial structure improvement agreement with

a creditor of a financial institution - In need of restructuring or financial structure improvement

- Received inappropriate audit opinions

- Capital impaired company

- Whose debt-to-equity ratio exceeds 1.5 times the industry average

- Dishonored bill and loss of uncollected bond are more than 5%

of the previous turnover - Receive disqualified investment ratings of corporate bond from credit

rating agencies - Have operating losses for the last two consecutive years at the end

of each fiscal year

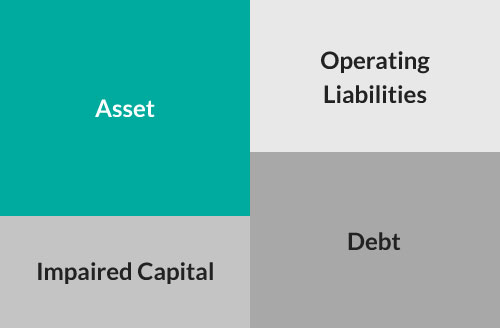

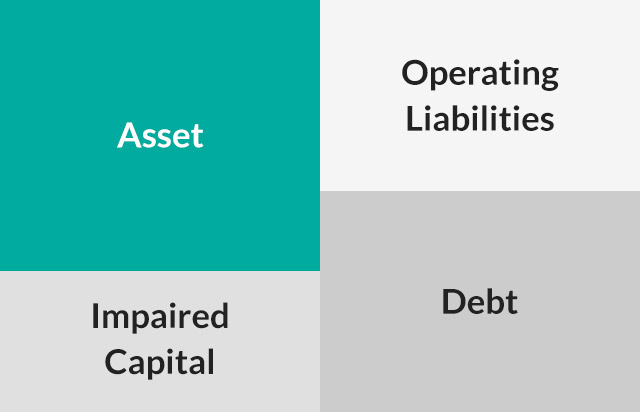

Financial Statement

before Investment

Normal business activities and investing in facilities are impossible due to the outflow of financial expenses and excessive debt compared to corporate value and operating profit

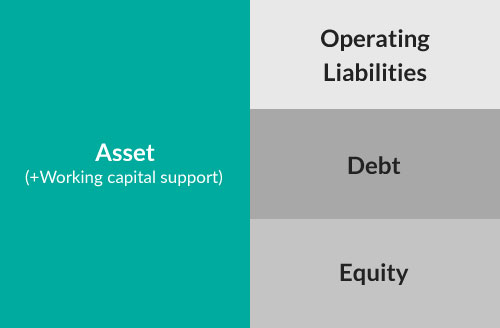

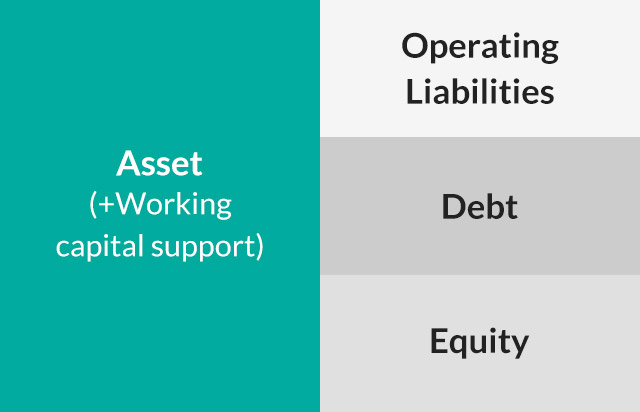

Financial Statement

after Investment

Stable business activities are available by improving the debt ratio through financial restructuring and receiving supports of working capital

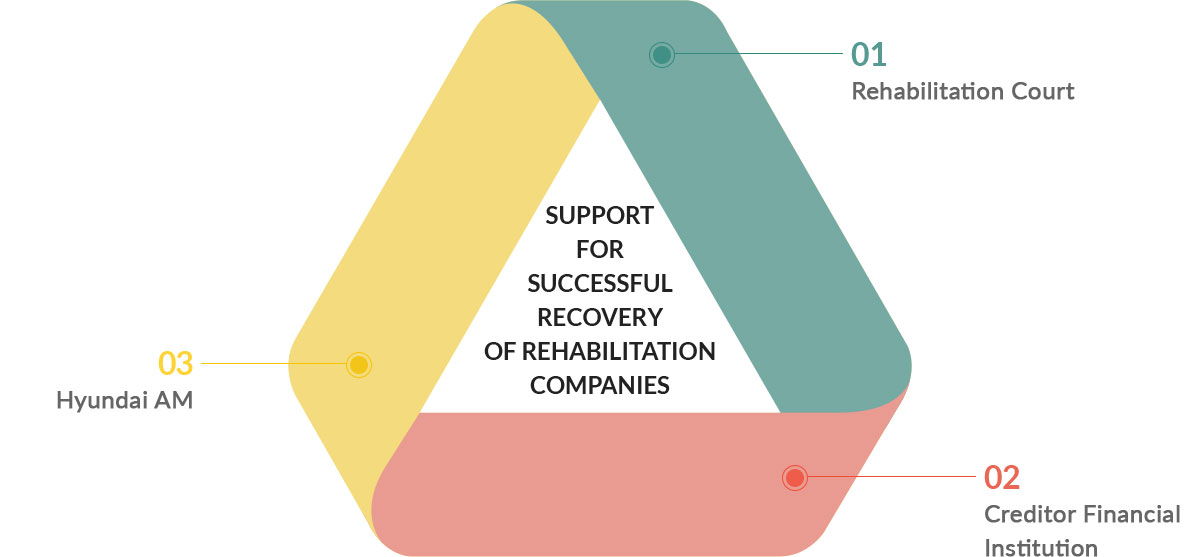

Investment philosophy

Investment to support an efficient restructuring of marginal companies

- Rehabilitation Court

- Creditor Financial Institution

- Hyundai AM

- Supporting new fund to meet the needs of rehabilitation company

- Corporate improvement to normalize management

- Expanding the virtuous cycle model of early management normalization for rehabilitation companies

- Establish an investment model that satisfies both investment stability and profitability

Investment strategy

We devise to invest in the optimal structure for companies’ financial status by removing inefficiency and developing suitable Exit methods based on an evaluation of organizational value to fit in work circumstance. Through these sophisticated process, we seek to form effective strategies, so called ‘win-win,’ for both investors and investee.

- M&A

- P Plan

- DIP

Financing - NPL

Acquisition - Loan

- Paid-in

Capital Increase

- Eliminate Inefficiencies-

Increase Productivity - Investment to

necessary Equipment - Sell

Unused Property - Checking

Organizational System - Incentive-

Market Analysis

- M&A

- Call & Put Option

- Operating Cash - Loan

- IPO

- Disposal of

non-operating assets