Risk Management in Hyundai Asset Management initially operates in prior-prevention.

We devise to resolve any risk through active communication with management departments related to the risk factors by independently seeking bounds of the risk.

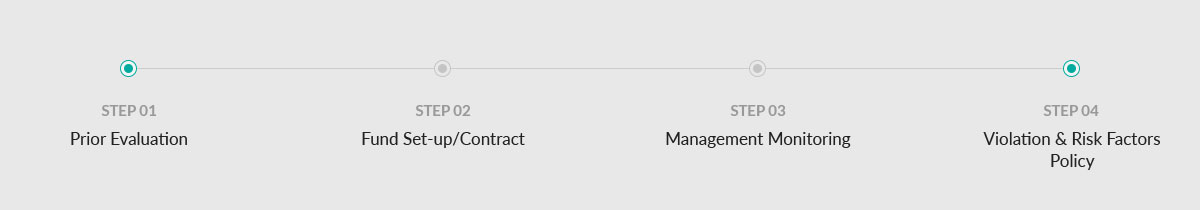

Internal Control Process

Pre-Review

Pre-Review

| Traditional Assets |

Alternative Assets |

- Devise the management strategy of risk factors

- Set a standard of risk management and application of risk tolerance limit

- Evaluate risk notification of investment proposal

|

- Risk factor confirmation based on assets

- Check expected cash flow

- Confirm related contracts

(law, unfavorable terms, etc.)

- Untact analyzation and Due Diligence

- Investment Proposal

|

|

Committee

Commodity Deliberation Commission

- Feedback following by preliminary review

- Submission of Investment Review Report

|

Set-up Fund and Contract

Set-up Fund and Contract

| Traditional Assets |

Alternative Assets |

- Applying Compliance checking system

- Register BM

|

- Check if the contract or investment proceeds under evaluation standards

- Examine contracts or proof documents

|

Fund Management Monitoring

Fund Management Monitoring

| Traditional Assets |

Alternative Assets |

- System-utilized real time Violation monitoring

- Screening management activities

- Operating monthly investment meeting

- Feedback and Outcome Analysis

|

- Checklist set-up and monitoring

- Exit sales rate, EOC Standards etc.

- Opening Quarterly AI Ex Post Facto Management Meeting

- Investment status and issue evaluation

|

|

Committee

Collective Investment Property Evaluation Committee

- Review the law and adequacy

|

If Regulatory violation and Risk Factors

If Regulatory violation and Risk Factors

| Traditional Assets |

Alternative Assets |

- Contents Share and Corrective order if the risk tolerance and violation exceeds

the limits

- Monitoring a measurement

- Future improvement method construction

- Decision of restriction following the rate of violation

|

- Immediate share of issue

- Discuss countermeasure

- Provide Legal Advices

|

|

Committee

Risk Management committee

- Report to board of directors

|